Probate is a legal process. It manages and distributes a deceased person’s estate. It ensures that a deceased person’s assets are handled as per their will, or, if no will exists, UK law. Probate can seem complex and overwhelming. So, many seek legal help.

How Much Do Solicitors Charge for Probate varies depending on several factors. It’s essential to understand them, as they depend on many factors. Knowing potential solicitor charges can help you plan and budget. Both small and complex estates can benefit from this. This guide will explain probate costs. We’ll cover what to expect when hiring a solicitor for help with the process.

The legal procedure for managing a decedent’s estate is called probate. It involves validating their will (if there is one) and distributing assets to the beneficiaries. If there is no will, the estate is distributed according to intestacy laws. Probate is usually needed if the estate has valuable assets, like property, bank accounts, or shares.

A key part of probate is obtaining a ‘grant of representation.’ It gives the executor, or administrator if no will, the power to handle the deceased’s estate. This includes tasks like paying off debts, managing taxes, and distributing assets to the beneficiaries. The personal representative is vital. They ensure the estate is handled properly and legally.

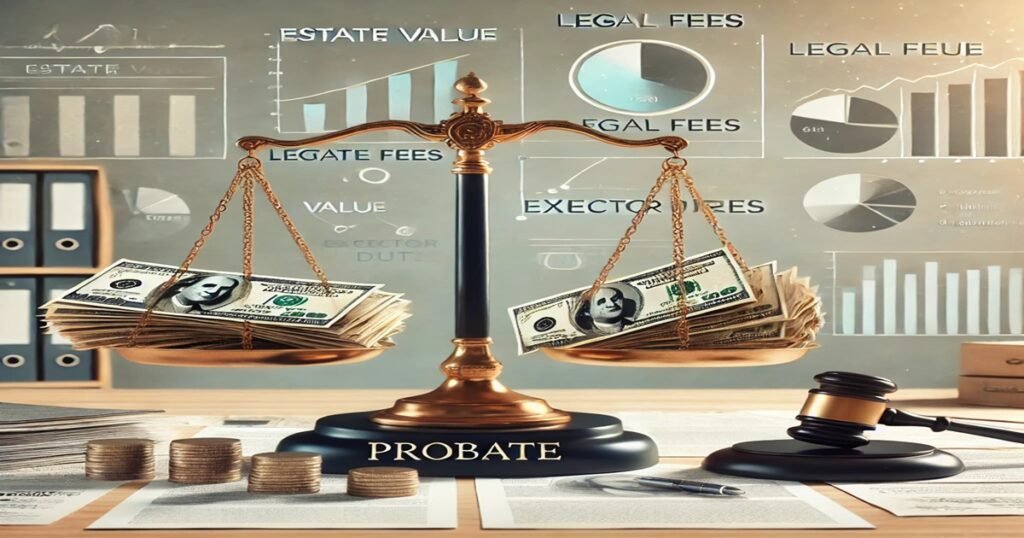

Probate costs can vary greatly. They depend on the estate’s size and complexity. Larger estates, or those with multiple or foreign assets, incur higher costs. Complicated finances also raise costs. This is because more time and effort are required to administer them. Smaller, simpler estates are usually less expensive.

Solicitors often charge either a fixed fee or an hourly rate for probate services. Fixed fees can provide more certainty for budgeting, as you’ll know the cost upfront. Hourly rates may suit estates needing flexibility. But, they can lead to unpredictable costs if the process takes too long. Knowing these options can help you pick a service that fits your needs and budget.

There are two main types of probate costs: solicitor fees and probate registry fees. The probate registry charges a fee to issue a grant of probate. This grant is needed to administer the estate. As of now, the probate registry fee in England and Wales is £273 for estates valued at over £5,000. Estates under this threshold typically don’t require probate, and no fee is charged.

Probate solicitor fees can vary by region and estate complexity. On average, you can expect solicitor fees to range from £1,000 to £5,000 for a simple estate. For more complex estates, fees may be higher. It’s important to note that solicitors may charge a percentage of the estate’s value or opt for an hourly rate. Probate costs are usually higher in larger cities like London. Professional fees are typically higher there.

The estate’s location can affect probate service costs. Prices in rural areas are often lower than in urban centres. It’s wise to compare solicitors and their fees. This will give you a clear picture of the costs.

When hiring a solicitor for probate, you’ll face two main costs: professional fees and disbursements. Professional fees cover the solicitor’s time and expertise in administering the estate. These fees can vary. They depend on the estate’s complexity, the solicitor’s fees, and the work involved. Expect higher fees for estates with multiple properties, foreign assets, or tax debts.

Disbursements are expenses the solicitor pays on your behalf and then bills to you. Common disbursements include a £273 probate registry fee for estates over £5,000. Other typical costs are: copies of the grant of probate (£1.50 each), bankruptcy searches (£2 per beneficiary), and asset valuation fees. Sometimes, legal notices are placed in newspapers to alert potential creditors. This can cost around £200.

It’s important to ask your solicitor for a breakdown of all fees and disbursements. This will help you budget. This transparency ensures there are no surprises once the probate process is underway.

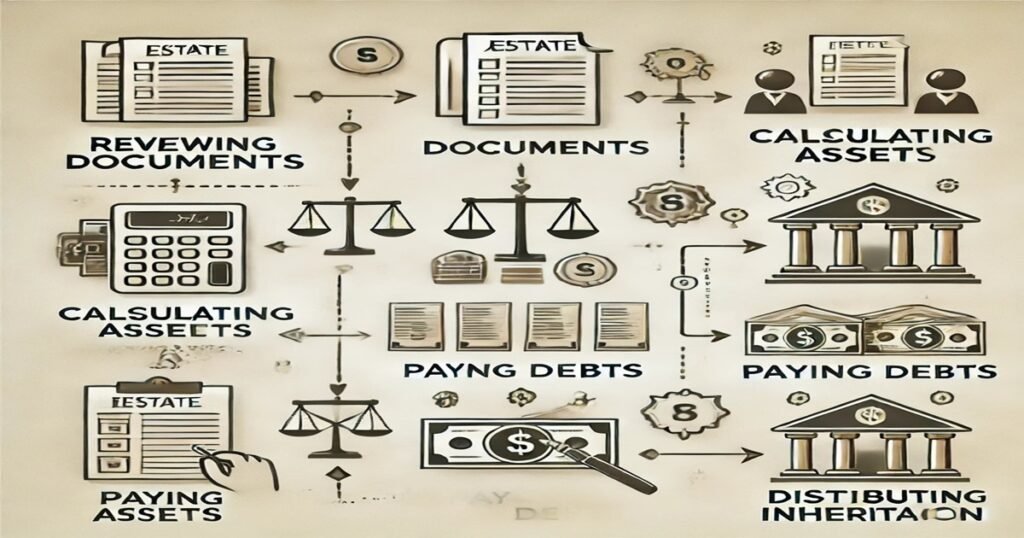

Administering an estate involves several steps. It starts with obtaining a grant of probate. The authority to administer the estate is granted to the personal representative by this agreement. This includes executors and administrators. Once the grant is secured, the next step is to value the assets. These include property, bank accounts, and personal possessions.

The personal representative must then handle any outstanding debts and taxes. This includes paying off creditors and, if needed, the inheritance tax to HMRC. You pay inheritance tax on estates worth over £325,000. Some exemptions and reliefs, like agricultural or business property relief, may apply.

After paying debts and taxes, the rep can distribute the rest to the beneficiaries. This is done per the will, or intestacy rules if there is no will. The personal representative must also prepare and submit estate accounts. These accounts must detail how the estate has been administered. Each of these steps must be handled carefully to ensure the estate is administered in line with the law.

Choosing the right probate solicitor is key to ensuring the process runs smoothly. Find a solicitor with expertise in probate and estate admin. They will know the legal requirements and potential challenges. It’s also important to select a solicitor who offers transparency in their pricing. Clear, upfront communication about fees will help you avoid surprises. This applies to both fixed and hourly rates.

You can manage probate on your own. But, it’s best to get professional help. It can save you time and stress, especially with a complex estate. A solicitor can help with legal paperwork and tax matters. They will ensure the estate is distributed correctly. You’ll feel more at ease knowing this throughout a trying period.

Opting for a fixed fee probate service can offer significant advantages. The main benefit is clarity. Knowing your total cost from the start removes the uncertainty of hourly billing. A fixed fee means no surprise costs as probate unfolds. This can be a relief when dealing with an estate’s administration.

Fixed fees also simplify budgeting, as you can plan your finances with confidence. This method works well for estates with simple probate needs. The solicitor’s work is easier to predict. Hourly billing can cause fluctuating costs if unexpected issues arise. Fixed fee services are more reassuring. They can also streamline probate, making it easier.

In some cases, it’s possible to manage probate without hiring a solicitor. This option may be feasible if the estate is simple, with no inheritance tax due and minimal assets. If you’re good with legal paperwork and have time, you could save on solicitor fees by doing probate yourself.

However, a DIY approach carries certain risks. Mistakes can be costly. They may arise from misunderstanding legal requirements, overlooking tax liabilities, or misallocating assets. In complex estates with many assets or creditors, probate can be overwhelming. Professional help ensures everything is done right and by the law. It helps you avoid potential issues.

Probate often involves more than simply distributing assets. Estates with multiple properties, foreign assets, or disputed wills can be complex. It’s vital to meet all legal requirements. This includes identifying beneficiaries, resolving disputes, and getting court approvals.

Tax responsibilities are another significant aspect of probate. The personal representative must calculate and pay any inheritance tax due on the estate. They must also settle any unpaid income or capital gains taxes. Mistakes in these tax matters can cause penalties or delays in finalising the estate. Property issues can complicate probate. This is true if there are multiple properties to value, sell, or transfer to beneficiaries. All land registry requirements must be met. This is key to a smooth transfer of ownership.

These legal, tax, and property issues can be daunting. So, expert advice is often vital to avoid costly mistakes.

Understanding how much do solicitors charge for probate is key to managing the process effectively. Many factors can affect the cost, including solicitor fees, disbursements, tax responsibilities, and estate complexities. Choosing between fixed fees and hourly rates will help, and knowing what services you need will keep the probate process manageable.

Some may choose to handle probate on their own, but expert advice from a solicitor can simplify the process. It can also provide peace of mind, especially for complex estates. The right guidance can save time, stress, and legal issues, ensuring everything is handled properly.

If you’re dealing with probate and want expert help, we offer a free consultation to guide you through the process. Contact us today, and we’ll provide advice tailored to your needs. Let us take the stress out of probate, so you can focus on what matters most.

Orange Legal is a trusted legal service provider, committed to your legal needs. Experienced, compassionate, and dedicated legal professionals here to serve you.

© 2024 Orange Legal | All Right Reserved. Website Design by Web Head Way